Hume Dam Albury

Tags

Albury

Australia

Dam

Lake

Sarah

Tags

Maternity Shoot

Maternity

Grass

Reindeer

Stuffed Animal

Stuffie

Christmas

Christmas Baby

Mt. Vernon Trail

Portrait

Expression

Water

SarahTagsMaternity ShootMaternityGrassReindeerStuffed AnimalStuffieChristmasChristmas BabyMt, Vernon TrailPortraitExpressionWater

Legal authorities unwinding the brokerage operations of MF Global Holdings Ltd. in the U.S. and U.K. could be heading for a legal clash over $600 million to $700 million in customer money that both sides consider to be their responsibility.

James Giddens, the U.S. trustee unwinding MF Global's domestic brokerage unit, on Friday disputed the stance of KPMG, which is unwinding MF Global's London-based arm, over the legal classification of the money.

"We would hope to resolve it, but this certainly could end up in a U.K. court," a spokesman for Mr. Giddens said on Friday. Mr. Giddens has retained legal counsel in the U.K. in advance of any legal skirmish, according to the spokesman, Kent Jarrell.

The disputed funds don't make up part of the $1.2 billion in customer money that remains unaccounted for, he said. That means if it can't be returned, clients in the U.S. might have lost close to $2 billion in various accounts at MF Global across the world.

Officials for KPMG weren't immediately available for comment.

The dispute highlights the lengthy and messy process of returning billions of dollars in customer funds, which has dragged on for nearly two months after MF Global's Oct. 31 bankruptcy filing. The effort has been complicated by the estimated $1.2 billion shortfall in customer money that has yet to be fully understood by regulators and investigators, including the Federal Bureau of Investigation.

More on MF Global

MF Global Transfer Scrutinized 12/21/2011

Opinion: Corzine and the Missing Money

Topics: MF Global

Mr. Jarrell said Friday that both Mr. Giddens and KPMG see the $600 million to $700 million in question falling under their respective jurisdictions. The picture is clouded because the U.S. and U.K. maintain different bankruptcy and regulatory regimes.

No funds used to back up transactions on international exchanges have been returned yet, according to Mr. Jarrell, and authorities haven't settled on just how much money is out there.

KPMG aims to carry out its own "interim distribution" of the funds, according to a statement last week from Richard Heis, joint special administrator of MF Global UK for KPMG.

A series of asset transfers has reunited former clients with 72% of the property held in U.S. segregated accounts, which had been used to trade on futures markets like the New York Mercantile Exchange and the Chicago Board of Trade. The trustee has estimated that the total U.S. figure could be at least $5.9 billion.

About 80% of MF Global customer funds linked to non-U.S. trading are likely in the U.K., a hub for trade in metals and contracts linked to short-term European interest rates, according to Mr. Jarrell. Nearly all of the 1.6 million open trading positions of customers have been closed or transferred since KPMG took over as administrator of MF Global's U.K. arm Oct. 31, the firm reported last week, representing more than $1.5 billion in collateral.

—Marietta Cauchi contributed to this article.

Write to Jacob Bunge at jacob.bunge@dowjones.com

MF Global Holdings Ltd., KPMG, MF Global, MF Global, customer funds, MF Global customer

MONTEVIDEO, Uruguay–The countries of a South American customs union agreed to work to block ships flying flags from the disputed, British-held Falkland islands from dropping anchor in their ports.

The Mercosur group includes Argentina, Brazil, Uruguay and Paraguay with Bolivia, Chile, Colombia, Peru and Ecuador as associate members.

The presidents of the four full member countries signed a declaration Tuesday vowing "to adopt, in conformity with international law and respective domestic legislation, all the measures it's possible to impose to impede the entry of boats flying the illegal flag of the Malvinas Islands," according to a copy of the agreement released by the Argentine foreign ministry. Argentina refers to the islands as the Malvinas.

Britain has controlled the islands since 1833 and fought a two-month war with Argentina over the territory it claims in 1982, resulting in the deaths of 255 British and 649 Argentine soldiers.

Argentina increased its claims of sovereignty over the Falklands, as well as South Georgia and South Sandwich Islands, following the start of oil and gas exploration last year by London-listed oil-and-gas exploration companies Falkland Oil & Gas Ltd., Rockhopper Exploration PLC, and Desire Petroleum PLC.

In February 2010, Argentina began requiring ships sailing to or from the Falkland, South Georgia and South Sandwich islands to seek permission if they want to travel through Argentine waters.

The couched language of the Mercosur declaration contrasts to a more forceful stance taken by Uruguay on behalf of Argentina, which continues to claim the islands and refuses to acknowledge British control.

Earlier in the meeting Uruguayan President José Mujica said in a statement that he would block Falkland Island-flagged ships from entering Uruguayan ports, although said his country would do nothing to stop ship's flying different colors from sailing to the British-held islands.

However, navy ships from the U.K. bound for the Falkland Islands would not be allowed to port in Uruguay "for reasons of solidarity with Argentina," Mr. Mujica said.

The U.K. Foreign Office said Wednesday it was concerned by the Mercosur decision.

"It is unacceptable to engage in an economic blockade of the Falklands. Mercosur should take the responsible decision and not do this. There can be no justification – legal, moral or political – for efforts to intimidate the people of the Falkland Islands," a British foreign office statement said on Wednesday.

Sparks flew earlier this month when Uruguay turned back a Spanish-owned fishing boat flying a flag from the Falkland Islands.

On Friday, Britain summoned Uruguay's ambassador to voice its complaints over the move, but Mr. Mujica stood firm. "We don't have anything against England, but we've got a lot in favor of our neighbors," he said in a statement.

The U.K. has repeatedly said that its sovereignty over the three groups of islands, whose inhabitants are overwhelmingly of British descent, isn't negotiable.

Write to Shane Romig at shane.romig@dowjones.com

Argentina, Mercosur, Mercosur online, Uruguay, Falkland islands, Malvinas Islands, Falkland, Falkland Islands, South Georgia and South Sandwich islands, Falkland Oil , South American customs union, Rockhopper Exploration PLC

Szabadsg hd I

Tags

Blaue Stunde

Brcke

Budapest

Freedom Bridge

Freheitsbrcke

Freiheit

Himmel

Hungary

Licht

Magyarorszg

Szabadsg

Szabadsg hd

Ungarn

Wasser

Wolke

Wolken

available

available light

blau

blue

blue hour

cloud

clouds

hour

hd

light

night

sky

beach

Tags

hawaii

oahu

day 4

polynesian cultural center

habitat

flowers

holiday

vacation

nikon

beach

summer 2011

water

blue

Seagull Bokeh

Tags

seagull

gabbiani

salerno

bokeh

dedio

Nikon

D80

campania

bird

uccelli

mare

sea

outside

Snow in Rayleigh, Essex in December 2010

Crown Hill, with Rayleigh station on the far right. A thaw has begun to set in. A year after taking these pictures, it has not snowed so far in Rayleigh during December 2011, although I wouldn't rule it out for January/February!

Tags

Rayleigh

Essex

England

PUESTA

Tags

puestas

puesta

BEGONI

FOTO

FOTOS

MAE

ROJO

NUBES

PALMA DE MALLORCA

sombra

sol

vistas

vista

photo

photos

luz

cielo

azul

Editor's note: This is the first in a series of articles in which readers tell us about their favorite trips and destinations. Send us your suggestions at next@wsj.com.

More in Next: The New Retirement

Saving the World, One Vacation at a Time

How to Make Your Nest Egg Last Longer

Encore Careers, From Personal Chef to Minister

When Heaven Is a Harley

A New Life in Costa Rica

Read the complete report .

30 Great Places to Retire: A Journal E-Book

Read 30 of Next's most exciting profiles of retirement destinations across the U.S. and overseas, complete with photos and quick facts for easy comparisons. This e-book, which can be viewed on all devices, is available for $3.99 at WSJ.com/eRetire.

For years, my wife, Caroline, and I have enjoyed walking. (As Thomas Jefferson observed: "Of all exercises, walking is the best.") Happily, walking for health translates well into walking vacations.

Options for such trips abound. Europe offers many of the best opportunities for walking tours, with bucolic landscapes and villages and historic (and prehistoric) sites. Britain, in particular, has a walking culture, with many well-maintained trails. (See nationaltrail.co.uk.)

The Cotswold Way is one of our favorites. This quintessential English walk is 102 miles long. It starts about two hours northwest of London and generally runs north and south, following a limestone ridgeline. The trail takes amblers along hillsides and through fields, woodlands and idyllic towns, with names like Birdlip, Chipping Campden and Little Sodbury. History is everywhere; prehistoric bands, Celts and Romans all traveled the Cotswold Way, each group leaving its mark and building upon those left by others.

![[FAVE]](http://si.wsj.net/public/resources/images/NX-AA238_FAVE_DV_20111216111321.jpg) Maxwell family

Maxwell family

The Cotswold Way runs about 100 miles from the market town of Chipping Campden in the north to the ancient city of Bath in the south.

Clotted Cream

We found the walk neither too strenuous nor too easy. Though the trail is generally well marked, we got lost on occasion, often while in conversation or admiring a view. That was part of the fun. We enjoyed visiting elegant gardens and horticultural centers, museums, ancient burial sites and churches, assorted historic structures and battlefields. We stopped in trail-side tea shops that served scones and clotted cream (much like whipped butter), and we chanced upon a village picnic on a hillside, with face painting, musicians and homemade ice cream.

On one occasion, I learned the hard way that what looks like mint can, upon hand examination, be a stinging nettle. We delighted in the wide selection of farmsteads, inns, pubs, and impeccable bed-and-breakfasts, and found without exception that the operators were cordial and helpful. We still correspond with some.

Well Met

Although the trail is not overly traveled, we routinely met and chatted with fellow walkers from numerous locales and walks of life. We particularly enjoyed dining and walking with Nicole and Walter, a couple employed in the Dutch film industry.

Averaging between 13 and 15 miles a day allowed us to get in top shape and shed a few pounds. At the end of each taxing day, we knew we had fairly earned a hot shower, a gourmet dinner—of lamb cutlets, for example—and a 16-year-old Lagavulin single malt or Strongbow fortified cider. Each morning found us refreshed by an ample English breakfast and most willing to press on.

At the southern terminus of the walk, the ancient city of Bath provided superior opportunities for shopping (Bath aqua glass, artisan handbags), dining (Sally Lunn's, the Pump Room, Jamie Oliver's), sightseeing (museums, Roman ruins) and relaxation in modern rooftop thermal baths, Roman-style, and eucalyptus and menthol showers. Walking the trail in our own way had enriched the experience and provided a memorable vacation.

Mr. Maxwell is a lawyer, walker and writer in North Carolina. He can be reached at next@wsj.com.

Thomas Jefferson, Cotswold Way, Bath

BUDAPEST—European Union and International Monetary Fund officials broke off preliminary talks with Hungary over new financial backing because of fears the government is trying to limit central bank independence and lock in fiscal policies before any loan agreement can be negotiated, people familiar with the situation said.

Heavily indebted Hungary—under threat from rising borrowing costs and a sharply depreciating currency as global markets shudder—said last month it would seek cooperation with the IMF and EU for a "safety net" that would reassure investors about the country's stability and credit-worthiness.

EU monetary-affairs spokesman Amadeu Altafaj-Tardio said Friday the EU, along with the IMF, "decided to interrupt the preparatory mission" in Hungary because of concern about "the intention of the Hungarian authorities to push forward with the adoption of laws that can potentially undermine the independence of the central bank."

The IMF issued a similar statement, adding that central bank independence "is one of the cornerstones of sound economic management." The fund said it would stay in touch with Hungarian authorities "to determine the next steps." Hungary's currency, the forint, fell 1.4% against the euro after the comments, before regaining ground—to 0.78% lower in late trading.

In a statement, Hungary's chief representative at the talks, Tamas Fellegi, said "this in no way means the interruption of the official negotiating process," emphasizing that this week's talks were informal consultations. He added that Hungary remains ready to begin formal talks in January without preconditions.

It isn't clear how the latest events will affect Hungary's stance on joining the proposed EU fiscal pact agreed to at last week's summit. Hungary's Parliament is to discuss whether the country should sign on. Officials say they are awaiting details of the agreement. Hungary supports measures to enforce budget discipline, but it doesn't think taxes should be harmonized across the EU.

The Parliament this week speeded up consideration of legislation to change the management structure of the central bank and the makeup of its interest-rate setting committee. The National Bank of Hungary and the European Central Bank have criticized the law as a possible threat to the central bank's freedom. Lawmakers in Hungary also are weighing a so-called financial-stability law that would cement tax and debt policies—and require a two-thirds majority of the legislature to agree to future changes. If the law passes, it would limit the government's flexibility to negotiate budgetary requirements for any loan package. The new legislation, for example, mandates a flat tax on incomes, rather than any progressive rate.

In their public statements, Hungarian Prime Minister Viktor Orban and his aides have stressed they want a precautionary agreement with the IMF and EU. Because they don't intend to draw on any credit line, they have said, they expect the strings attached to the money to be limited.

On Friday morning, Mr. Orban said in a radio interview that once formal talks begin, "the government doesn't wish to discuss its economic policies with the IMF." He said the talks were, in effect, "Hungary negotiating with its own bank," since it is a member of the IMF.

Market analysts have said the more conditions attached to any IMF and EU loan package, the more reassuring it is likely to be to investors, who have been skeptical about some of Hungary's unorthodox policy decisions in the past, such as a move last year to bring privately managed pension funds back into state coffers.

Hungarian officials have said they are seeking a precautionary liquidity line, a type of arrangement that the IMF extends to countries that it considers to be in strong fiscal shape and pursuing prudent policies. The IMF won't comment on its position.

In an interview Friday, Zoltan Csefalvay, a state secretary in the Economy Ministry, expressed openness to other types of deal. "We'll see what the IMF offers," Mr. Csefalvay said.

He stressed that Hungary is in much better shape than it was in 2008, when it became the first European country to be bailed out by the EU and IMF when global credit markets froze after the collapse of U.S. investment bank Lehman Brothers.

Mr. Csefalvay said Hungary's economy expanded in 2011, its budget deficit is below 3% of gross domestic product as required by the EU, and its current account—a measure of international trade and payment flows—is in surplus.

—Veronika Gulyas and Gergo Racz contributed to this article.

central bank independence, Hungary, Hungarian authorities, central bank, Hungarian Prime Minister Viktor Orban, BUDAPEST—European Union

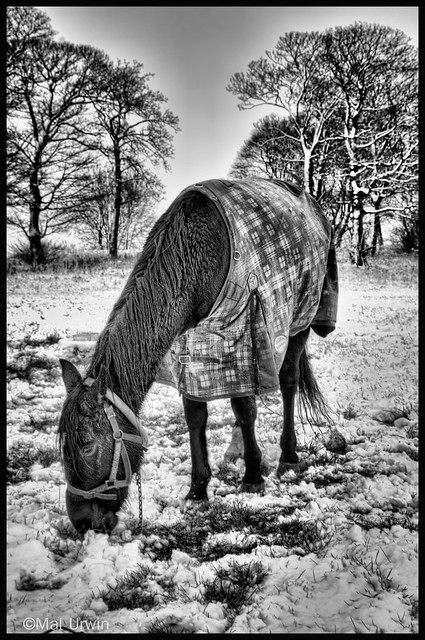

Horse in the snow B&W

Tags

snow

winter

HORSE

FEEDING

HDR

BLACK AND WHITE

COLOR

TYNESIDE

WINDY NOOK

GATESHEAD

Geronimo

Takes you up to the top of Apache Peak. My legs just aren't strong enough for all that powder.

Tags

Sunrise Ski Park

White Mountain Apache Tribe

Greer

Arizona

snow

ski

The world's financial system showed new signs of strain on Wednesday as banks and investors clamored for U.S. dollars and two European banks took emergency measures to address the deepening crisis.

Enlarge Image

Close

European Pressphoto Agency

Members of the Italian Northern League Party demonstrate in Parliament with placards saying 'stop taxes.'

Stresses rippled through debt and stock markets despite measures taken by European leaders last week to help restore investor confidence. Reflecting the tension, rates that banks charge each other for short-term borrowing in dollars continued to climb, hitting their highest level since July 2009. Long-term Italian government bond yields jumped back above 7%, a level that would crimp Italy's ability to borrow in the future. Amid the rush for dollars, the euro dropped below $1.30 for the first time since January.

More

Leaders Grow Further Apart

Heard: Euro's Resilience Cracks

Crédit Agricole SA, France's third-largest bank, said it will exit 21 of the 53 countries in which it operates to help shore up its finances. Commerzbank AG, struggling to avoid accepting a bailout by the German government, is in negotiations to transfer suspect assets to a government-owned "bad bank."

The Dow Jones Industrial Average dropped 1.1% to 11823.48. Markets in Japan, Australia and South Korea each fell more than 1% in Thursday morning trading.

Investors fret that the recent steps taken by Europe's leadership have done little to dissipate the growing strains across the markets. The concern is that with no solution in sight to the sovereign debt crisis, banks, which hold hundreds of billions of dollars of European government bonds, are at risk of suffering massive losses, threatening to cripple the Continent's banking system.

In this environment both investors and banks are demanding higher interest rates in return for the risk. Some are just refusing to lend. The retreat threatens to create a vicious cycle for the euro zone and could worsen the impact on the region's already weak economy. Europe is far more dependent on lending from its banks than the U.S. economy, where financial markets play a greater role financing companies and individuals.

"The problems are very large and the solutions are very difficult," said Gerard Cassidy, a bank analyst at RBC Capital Markets.

European banks are exposed to big potential losses in countries like Italy and Spain. The banks have huge portfolios of government bonds, and an increasingly likely European recession would hurt the value of all their assets.

Enlarge Image

Close

In the U.S., the government stepped in to prop up ailing banks during the 2008 financial crisis. Only after the banks were stable did they ask private investors for more capital to shore up their balance sheets. In Europe, the approach has been the reverse, in part because many European governments have piled up debt without having yet bailed out their banks.

Fitch Ratings on Wednesday evening lowered its ratings on five big banks from Denmark, Finland, France and the Netherlands. Fitch said the downgrades reflected deteriorating market conditions.

Earlier in the day, focus was on the potential downgrades of sovereign nations, as France's finance minister played down the potential impact of any downgrade of France's Triple-A rating.

As the European financial crisis developed, concerns about the euro-zone banking system have mounted. Earlier in 2011, U.S. money-market mutual funds, long important providers of short-term cash to European financial firms, began to cut down their exposures to the region sharply. Banks have been able make up for some of that lost liquidity by borrowing at the European Central Bank. But analysts estimate European banks have more than €700 billion of debt maturing next year that must be refinanced.

Enlarge Image

Close

Reuters

Jens Weidmann, president of Germany's Bundesbank, opposes the ECB printing money to ease the crisis.

European leaders continued to resist some of the sweeping measures investors were seeking—such as the ECB buying sovereign debt en masse, or the creation of a common euro-zone bond. Jens Weidmann, president of Germany's Bundesbank and member of the ECB governing council, said he remained vehemently opposed to the ECB printing money. German Chancellor Angela Merkel reiterated that creating such a bond would be no solution to the turmoil.

Europe's troubles are weighing on financial institutions around the world. In Sydney, Westpac Banking Corp. warned Wednesday that Europe's debt woes will impact the price and possibly the availability of credit to Australia's banks.

"Right at the moment, as you know, term markets around the world are effectively closed," Westpac Chief Executive Gail Kelly told reporters after the bank's annual meeting.

Short-term financing costs for banks dropped briefly following a coordinated move late last month by the world's central banks to ease strains in the debt markets. But traders on Wednesday noted that all but the top banks have lost access to these markets again. Many are now turning to the European Central Bank, which has stepped up its lending in recent days.

Euro Zone Crisis Tracker

See economic, political and markets news from across Europe as governments and financial institutions deal with the continuing debt crisis.

View Interactive

Debt, Doubt and the Euro Zone

See country-by-country events in the crisis.

View Interactive

Key Players in Europe's Debt Crisis

Europe's political and financial leaders

View Interactive

More photos and interactive graphics

European banks are seeking dollars to fund U.S. operations and dollar-denominated loans. On Wednesday, demand surged for the ECB's seven-day fixed-rate dollar funding. The ECB said that it allotted $5.122 billion, up sharply from $1.602 billion last week.

The cost of borrowing dollars for three months in the London interbank market rose steadily higher. Costs of borrowing greenbacks in those markets are now at the highest levels since July 2009.

"People are doing anything they can to get dollars on their books," said Scott Graham of government bond trading BMO Capital Markets in Chicago.

In announcing its plans to retreat from various markets, Paris-based Crédit Agricole also said it will boost reserves, cut costs and trim its reliance on market borrowing.

The moves by Crédit Agricole and Commerzbank are part of a bigger effort by Europe's banks to become leaner institutions. They are ditching business lines, selling assets and closing up shop in foreign markets. In short, the banks are bowing to market and regulatory pressures to get smaller while building thicker capital buffers to protect against unexpected losses.

There's "an underlying sickness" in the European banking industry, said Ronit Ghose, a European banking analyst at Citigroup. Lenders are trying to recuperate by dumping peripheral businesses and cutting back even in core areas.

Deposits at foreign-owned banks and U.S. branches of foreign banks have fallen 20% since May, according to Federal Reserve data, to a recent $877 billion. That's a sign that customers are moving their money elsewhere.

—Liz Rappaport, Tom Lauricella and Ross Kelly contributed to this article.

Write to Matt Phillips at matt.phillips@wsj.com and David Enrich at david.enrich@wsj.com

Online.wsj.com

Holden Commodore SS Police Car

Victoria Police (Melbourne)

Tags

Australia

car

Holden

Commodore SS

Victoria

Villages de Balagne

Santa Reparata Di Balagna, le hameau de Palmento

Tags

Nikon

Corsica

Photos

Corse

Ile De Beaut

Paysages

Kalliste

Bastia

Ile

Porto Vecchio

Calvi

Tete De Maure

Mediterrane

Sud

Ile Rousse

soleil

mer

nature

D7000

Balagne

Libert

Fleurs

Phare

Pictures

Sun

Sunset

Sunrise

Bateaux

Bleu

Fenetre

Mditerrane

Serra

Vert

Pigna

Transparence

Beaut

Arbres

Barque

Dame

Beach

Blue

Color

Europe

Flowers

France

Graffiti

Green

Island

Landscape

Light

Night

Photo

Photographie

Photography

Rouge

Red

Sea

Et

Printemps

Summer

Spring

Eau

Water

Arbre

Tree

Pierres

rocks

rock

Pierre

Ice sculpture

Snow and Ice Sculpture Festival in Bruges 2011

Tags

Snow

Ice

Sculpture

Festival

Bruges

2011

Walt

Mar Gelada

Una toma que no me gust nada al verla en el lcd de la cmara (razn por la cual la descart sin exprimirla al mximo), pero que luego me ha gustado bastante en el ordenador. Con el filtro degradado de 3 pasos. Procesado: ajuste de niveles, levantando un poco las sombras, y ligera mscara de enfoque.

Tags

altea

olla

platja_olla

sierra_helada

serra_gelada

alicante

costa

paisaje

mar

sea

seascape

Fernando_Prieto

Nikon_D5000

Mar GeladaUna toma, gust, lcd, cmara, descart, ordenador, el filtro, pasos, niveles, las sombras

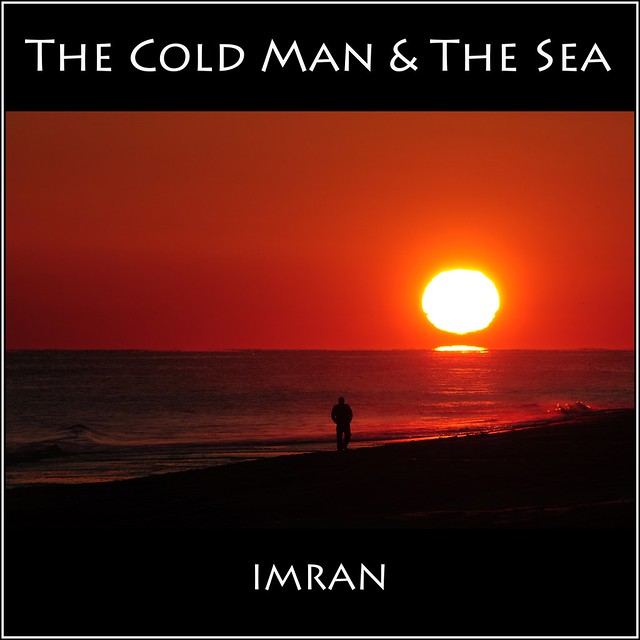

The Cold Man & The Sea - IMRAN™

In keeping with the series of photos you have loved, The Old Men And The Sea, The Odd Man And The Sea, The Young Woman And The Sea, and The Young Boy And The Sea, I am happy to share this photo for which I braved the frigid weather on the Fire Island, Long Island, NY, beach last evening…

The Cold Man And The Sea is the perfect title. It is reflective of the hands in the pockets, as well as the fact that one of the waves rolling on to the shore soaked my dress shoes & socks, drenched my feet, and chilled my bones until I got the car heater warm enough on the drive back home to start to thaw me out!

Absolutely no color editing, changes or color processing done to this photo from the Nikon D300 working optimally again.

I hope you will enjoy this cold and coldly beautiful moment with warm feelings (and in your warm homes or offices).

© 2011 IMRAN

DSC_8471

Tags

2011

Atlantic Ocean

Beach

Clouds

D300

Fall

Flickr

Framed

IMRAN

ImranAnwar

Landscapes

Long Island

Man

Marine

Nature

New York

Night

Nikon

Ocean

Outdoors

peaceful

Red

reflection

Silhouette

Sky

Square

Suffolk

Sun

Sunset

tranquility

Water

The Old Men, photos

East To Dan Ryan Expy

River North

Tags

interstate

snow

traffic

highway

blur

River_North

18mm-200mm

Chicago

Dan Ryan

Pelas ruas de Vienna...

Austria.

Tags

Wien

Vienna

Austria

Europe

Duna River

Rio Danubio

Music

Grand Caymen

Cruise 2011 - Grand Caymen

Tags

CYM

Cayman Islands

Cayman Palms

Dog City

Georgetown

Louisiana

New Orleans

USA

United States

Vieux Carre

Grand Caymen

Cruise 2011 - Grand Caymen

Tags

CYM

Cayman Islands

Cayman Palms

Dog City

Georgetown

Louisiana

New Orleans

USA

United States

Vieux Carre

Photos from the 2011 Tupelo Christmas Parade.

Nikon D700, 28-300mm Nikkor lens. Processed with Paintshop Photo Pro X4, using Topaz Black & White Effects.

You are cordially invited to visit my photoblog at zenofzann.wordpress.com to find out more about my work. You can also find me on Facebook at ZannWalker Photography, and you can follow me on Twitter @suzanne_hight. And now you can visit my official gallery at zannwalker.com.

Tags

Nikon

D700

28-300mm

Tupelo

Mississippi

Paintshop

Photo

Pro

X4

Topaz

Adjust

Christmas

parade

motorcycle

bike

Topaz Black , ZannWalker Photography, Facebook, Tupelo Christmas Parade, Nikkor lens

2129 Long View

Tags

oakley

ohio

window

snow

sorta

metro

gillig

cincinnati

centerofcincinnatishoppingcenter

Escampando

de la nada un poderoso torrente cae sobre la 26

Tags

aguacero

rain

storm

tormenta

bogota

razordab

colombia

dia

ciudad

citylife

car

traffic

trancones

agua

water

flood

A Once-Proud Vessel

The remains of the sailing ship Peter Iredale, run aground on Clatsop Spit by her captain in 1906, now lie buried in the sand at Ft Stevens State Park, Hammond, Oregon. Manual processing & BW conversion in LR3.

Tags

BW

Canon EF 24-105mm f/4 L IS USM

Peter Iredale

beach

canoneos5dmarkii

landscape

seascape

ship

travel

Hammond

Oregon

USA

Peter Iredale, Ft Stevens State Park, Hammond, Oregon

DURBAN, South Africa—China could agree to binding emissions cuts after 2020 if developed countries take far-reaching steps to mitigate climate change by then, a top Chinese official said Monday, in a subtle shift that could put the onus on countries such as the U.S. to take action.

Enlarge Image

Close

European Pressphoto Agency

Xie Zhenhua speaks during a press conference at the COP 17 Climate Change Conference 2011 in Durban, South Africa, Monday.

"After 2020...the framework, I think, should be a legally binding one," said Xie Zhenhua, vice chairman of China's National Development and Reform Commission and one of the country's top negotiators at United Nations-led climate talks.

"We accept a legally binding arrangement with [preconditions]," Mr. Xie said.

The China comments injected new energy into the second week of climate talks, which opened Nov. 28 to low expectations given long-standing disputes between the U.S., China and other major players. Yet the China pledge was attached to major conditions that have dogged recent climate negotiations. Some key participants also raised questions about what China's remarks really meant.

Mr. Xie's comments and other official Chinese statements in recent days implied a willingness for China to subject itself to binding climate emissions cuts. That would mark a significant shift from China's previous position. For years China has rejected binding targets for itself except in a distant and unspecified future.

U.S. and European negotiators said they wanted to clarify China's intent in private meetings with Mr. Xie.

"China has always been in favor of a legally binding outcome. The key question...is: Will a legally binding deal also mean that China is equally legally bound? That is the key point and that is where I think what we've heard yesterday still needs a lot of clarification," said Connie Hedegaard, European Commissioner for Climate Action.

China has in the past objected to international verification of its emissions, a long-standing demand of the U.S. to any deal.

"I don't know what he's saying yet, and I will be very happy to talk to him," Todd Stern, the chief U.S. negotiator in Durban, said when asked about Mr. Xie's comments. "I do know that up to now China has not been willing to do the kind of legally binding agreement that I'm talking about."

The U.S. favors firm individual commitments to cut emissions rather than an omnibus legal imperative for nations to cut emissions, Mr. Stern said. For the U.S. to agree to a binding deal, China would have to join the U.S. as a developed nation subject to the most stringent cuts, and other loopholes would have to be eliminated. "No trap doors, no swiss cheese," Mr. Stern said.

Mr. Xie's comments Monday and other Chinese statements in recent days point to at least a partial pivot from previous views, which have placed the burden for emissions reduction on developed countries. A statement by Mr. Xie in a story by the state-run Xinhua news agency implied a greater recognition of the need for developing countries to take action.

"Developed countries should bear for the historical responsibilities of climate change and lead the emission cut while providing fund and technology to developing countries for better responding the climate change," Mr. Xie said in the Xinhua report. "On the other hand, developing countries should take action in the framework of sustainable development," he said.

Conference organizers welcomed the apparent shift in China's negotiating position.

"It is China laying the cards on the table," said Maite Nkoana Mashabane, South Africa's foreign minister and president of the talks.

But Mr. Xie's pledge came with tough conditions. He said a proposed fund to mitigate the effects of climate change in the developing world must receive $30 billion by next year and $100 billion annually by 2020. And crucially, developed countries that have ratified the so-called Kyoto Protocol, an agreement to cut carbon emissions whose legal requirements expire next year, must agree to extend it, he said.

The U.S. never ratified the agreement, and already three Kyoto signatories, Canada, Japan and Russia, have said they will not extend the treaty. The European Union, which enacted Kyoto, has said it would support a second commitment period if there were an agreement on steps to take for a global binding deal in the decade.

After Mr. Xie spoke to a packed news conference here, Christina Figueres, the UN's climate negotiation chief, said the Kyoto Protocol could technically be extended even if those three nations bow out.

"Countries are now considering how do they bring a second commitment period into effect and not whether," to do so, Ms. Figueres said.

—Alessandro Torello in Brussels contributed to this article.

Write to Patrick McGroarty at patrick.mcgroarty@dowjones.com

Xie Zhenhua, climate change, climate change, China, legally binding, Durban, South Africa, developed countries, developed countries, South Africa, South Africa—China ebook download, European Commissioner for Climate Action.China, Pressphoto AgencyXie Zhenhua

morning breeze

Tags

azrudin

blue

architecture

bluehour

bridge

cloud

d7000

cityscape

city

digitalblending

dri

jetty

island

hdcpl

exposures

lowlight

malaysia

nature

panorama

nikon

photography

putrajayalakeclub

putrajaya

reflection

rock

scapes

stone

still

slow

sky

sifoocom

sunrise

tokina1224

verticalpanorama

New Orleans

Cruise 2011 - New Orleans

Tags

Algiers

Louisiana

New Orleans

USA

United States

Vieux Carre